"Taptap Send is an app that lets people send money back home quickly and at very low prices," says Helen Amelga, the company's US-Ethiopia Launcher. (Courtesy photo)

"Taptap Send is an app that lets people send money back home quickly and at very low prices," says Helen Amelga, the company's US-Ethiopia Launcher. (Courtesy photo)

Tadias Magazine

By Tadias Staff

Updated: January 20th, 2022

New York (TADIAS) — In the following interview Helen Amelga, the US-Ethiopia Launcher at Taptap Send, explains the newly launched mobile money transfer service, which is considered the first app-based platform to specifically focus on remittances from the Diaspora to people back home.

Helen, whom we have previously featured in Tadias for her public service work in the Ethiopian American community, was most recently the Deputy Area Director at Office of Councilmember Kevin de Leon in Los Angeles, California.

Helen Amelga, the US-Ethiopia Launcher at Taptap Send. (Courtesy photo)

TADIAS: Helen, thank you for your time and congratulations on your new position as Taptap Send’s US representative for Ethiopia.

Helen Amelga: Hi Liben, thank you for having me back. It is always a pleasure to chat with the Tadias team.

TADIAS: How are you enjoying your transition from public service to business? What are some of the rewards and challenges?

Helen: I always try to focus my work through a lens of service. From my positions working in local government here in California, to the work I do through the Ethiopian Democratic Club of Los Angeles, the focus is always on serving my community. My work as US-Ethiopia Launcher at Taptap Send is an extension of that service. Through this role I am able to apply my skill set to serve Ethiopians not only in the diaspora, but those directly on the continent as well.

The work is incredibly rewarding, through connecting people to remittance services I am able to help folks get money to loved ones back home, and beyond the individual, I get to help the larger Ethiopian economy. It’s a win win.

TADIAS: Please tell us about Taptap Send and its recently launched mobile money transfer service to Ethiopia. How does it work?

Helen: Taptap Send is an app that lets people send money back home to Africa and Asia quickly and at very low prices. Since launching in summer 2018, we’ve already moved tens of millions of dollars and reached tens of thousands of customers. We just raised $65 million in a Series B funding. We’re live in the UK, EU, US and Canada, and we support payments into Ethiopia and 21 other countries with more countries launching soon.

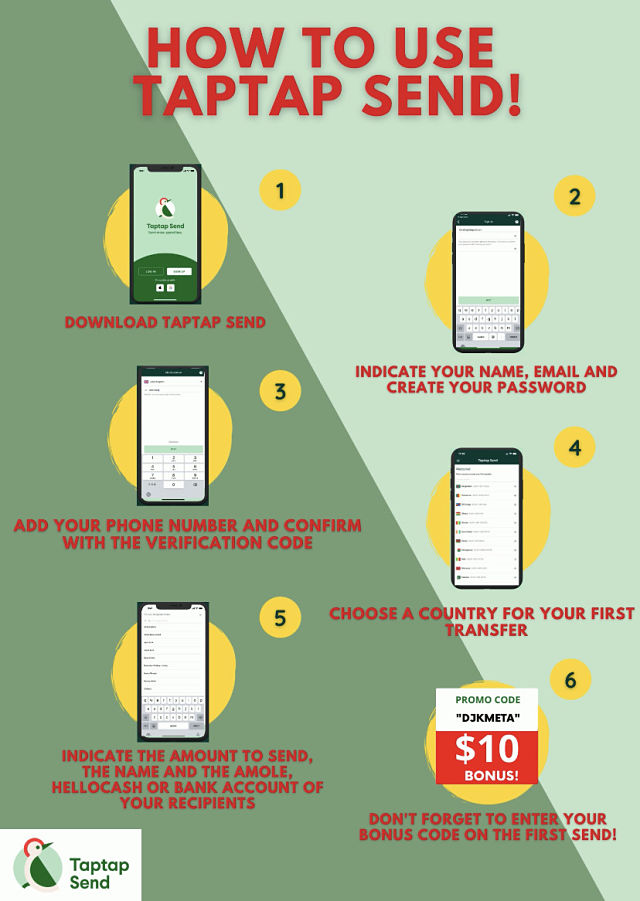

How it works is simple, a user in the US just needs to download the Taptap Send app from the Apple Store or Google Play, upload their bank or debit card details, then select a recipient in Ethiopia. The recipient does not need a Taptap Send account. Select a dollar amount and hit send. You’re done! The funds will be deposited directly into your loved ones account that day.

TADIAS: Taptap Send is also the first platform to specifically focus on Remittances from the Diaspora to people back home. How does it differ from other money transfer companies and what are the benefits for us here in the Diaspora?

Helen: Great question. Here at Taptap Send we believe in impact first. We exclusively pursue products and strategies that are in the interests of our customers and the communities we serve, while recognizing the tradeoffs this implies.

Direct benefits to Diaspora are that we offer a great exchange rate and same day transfers at no fee. The app provides quick and easy access to sending money quite literally at the tap of a finger. Many of us have been in a situation where a loved one has an emergency back home, whether it be medical or elsewhere, and we need to get them money fast. Taptap Send gives us the power to get that funds there quickly just by using our phone. No need to go into a bank or brick and mortar institution.

Sending money legally also grows the Ethiopian economy which has been experiencing a cash shortage for some time now.

TADIAS: What are the various financial institutions you are working with in Ethiopia?

Helen: We provide Bank transfers to Commercial Bank of Ethiopia and Dashen bank. Mobile money transfers can be made to Amole and HelloCash, both of which provide cash out options at their local service centers. We will expand to include Telebirr mobile wallet in the coming weeks.

E-wallets in particular are great because the recipients can use their wallet to fund transfers, pay bills and pay diverse merchants without needing to cash out. Taptap Send in partnership with these services is revolutionizing the way we send and spend money.

TADIAS: Do people in the U.S. need an account in Ethiopia to send money?

Helen: Nope, all they need is the Taptap Send app and a debit card.

TADIAS: According to a press release from the company “the UN has set a goal for remittance pricing and commissions to be no higher for any company than 3% of the total sent. Taptap Send says that it’s the only company in the space that has publicly committed to that goal.” Please tell our audience about that goal and the various fees involved in sending and receiving money?

Helen: Our CEO put it best:

Cross-border payments are not only a large market — $540B through formal channels alone, with the informal sector estimated to be almost as large — but are also the central source of capital for low and middle income countries: remittance inflows exceeded foreign direct investment plus official development assistance by in 2020. And they’re growing quickly: more than 7x since 2000. So it should come as no surprise that the United Nations included lowering the price of remittances to 3% as a top-level indicator to “reduce inequality” among their Sustainable Development Goals. The cost of global remittances is simply that important to the reduction in inequality. We’re proud to be the only remittance company (of which we’re aware) that has publicly committed to hitting that goal.”

(Courtesy photo)

TADIAS: Given that remittance is an important source of income for Ethiopia and the limitations involved in terms of mobile wallets services outside of major cities, what are your goals in terms of expanding services to the wider population?

Helen: Excellent question. Our goal is to expand our reach to Ethiopians in every corridor. It’s all about creating access and equity. We are currently working on growing our network to partner with banks throughout Ethiopia.

TADIAS: Is there anything else that you would like to share with our audience?

Helen: Don’t just take my word for it, download and use the app yourself. Leave a review and let us know what you think. I am also happy to connect with folks directly and answer any questions. Helen.Amelga@taptapsend.com

TADIAS: Thank you again, Helen, and best wishes from all of us at Tadias.

Helen: Thanks Liben! It’s always a pleasure talking with you. Until next time.

—

You can learn more at taptapsend.com.

Join the conversation on Twitter and Facebook.