The International Monetary Fund (IMF) headquarters in Washington, D.C. (Getty Images)

The International Monetary Fund (IMF) headquarters in Washington, D.C. (Getty Images)

Bloomberg

By Samuel Gebre

The International Monetary Fund backed Ethiopia’s plan to rework its debt under the Group of 20 common framework as it reached a staff-level agreement with the government on credit facilities.

To strengthen debt sustainability, the authorities aim to lower the risk of debt distress rating to moderate by re-profiling debt service obligations,” the lender said in an emailed statement on Tuesday. “In this context, the fund welcomes Ethiopia’s request for debt treatment under the G20 Common Framework.”

Ethiopia announced plans last month to rework its liabilities under the G-20 program that seeks to include private creditors into an agreement on debt relief for countries that need it following the fallout from the coronavirus pandemic. The nation’s Eurobonds plunged the most on record following the revelation, and then partly recovered after the government said it would only approach private creditors as a last resort.

Ethiopia Eurobonds Plunge as Nation Seeks G-20 Debt Review The IMF reached a staff-level agreement with Ethiopia on policy measures for the completion of the first and second reviews under the Extended Credit Facility and Extended Fund Facility arrangements, according to the statement. “Risks to the economic outlook are tilted to the downside,” the IMF said, projecting economic growth of 2% in 2020-21 and 8.7% in the following fiscal year.

Several economic and political uncertainties have hit the Horn of Africa nation from the pandemic to war in the northern Tigray region and a desert locust invasion. “A modest fiscal expansion is envisaged this fiscal year to accommodate the humanitarian assistance and reconstruction needs,” Sonali Jain-Chandra. who led the IMF staff team, said in the statement. “At the same time, the authorities are now moving to enhance domestic revenue mobilization.”

–

Related:

IMF, Ethiopia agree framework for loan deal reviews

The International Monetary Fund (IMF) logo is seen outside the headquarters building in Washington, U.S., September 4, 2018. (REUTERS Photo)

Reuters

Updated: February 24th, 2021

NAIROBI (Reuters) – The International Monetary Fund said on Tuesday it had agreed a blueprint for the completion of reviews of Ethiopia’s loan programme, taking account of the impact of the coronavirus and the country’s “domestic security situation”.

The International Monetary Fund (IMF) logo is seen outside the headquarters building in Washington, U.S., September 4, 2018. REUTERS/Yuri Gripas/File Photo

Agreed in December 2019, the three-year programme is worth $2.9 billion. Performance under it has been strong, the IMF said.

The reviews, whose timetable the fund did not outline, were “focused on balancing the need to address ongoing challenges created by the pandemic and domestic security” while laying the foundation for growth, IMF Deputy Division Chief Sonali Jain-Chandra said in a statement

The security situation “has created humanitarian and reconstruction needs that require an adjustment of policies and support from the international community,” she added.

The statement made no direct reference to the war that began in November when Prime Minister Abiy Ahmed ordered an offensive against the Tigray People’s Liberation Front (TPLF), the former ruling party in the northern region, after regional forces attacked federal army bases there.

Abiy declared victory less than a month later but low-level fighting continues.

Tuesday’s agreement is subject to approval by the IMF executive board.

Finance Minister Ahmed Shide and State Minister of Finance Eyob Tekalign Tolina did not respond to requests from Reuters for comment.

The Fund also said it welcomed Ethiopia’s request for “debt treatment under the G20 Common Framework.”

Last month, Ethiopia said it planned to restructure its sovereign debt under the framework, designed to help with economic pressures induced by COVID-19, and was examining all options.

The IMF said that economic growth is projected to be 2% in 2020/21, largely the effects of the pandemic, but it is expected to rebound to 8.7% in 2021/22 in line with a global recovery.

—

Related:

S&P joins Fitch in downgrade of Ethiopia on potential debt restructuring

S&P said it estimated Ethiopia’s public debt repayment needs at about $5.5 billion over 2021-2024, including a $1 billion Eurobond due in 2024. The ratings agency added that the economic effects of the COVID-19 pandemic have slowed Ethiopia’s economic activity in the services and industry sectors. (Photo: Addis ababa skyline/Wiki Media)

Reuters

Updated: February 13th, 2021

S&P Global Ratings on Friday downgraded Ethiopia’s long-term foreign and local currency sovereign credit ratings to ‘B-’ from ‘B’ on potential debt restructuring, announcing the move days after Fitch Ratings downgraded the country.

“Exacerbated by the effects of the COVID-19 pandemic, Ethiopia’s structurally weak external balance sheet has deteriorated further, in our view”, S&P Global Ratings said.

On Tuesday, Ethiopia’s sovereign dollar bonds dropped nearly 2 cents as Fitch chopped Ethiopia’s credit score by two notches after Addis Ababa signaled it could be the first with an international government bond to use a new G20 ‘Common Framework’ plan.

The scheme, which is open to over 70 of the world’s poorest countries, encourages their governments to defer or negotiate down their external debt as part of a wider debt relief program.

S&P said it estimated Ethiopia’s public debt repayment needs at about $5.5 billion over 2021-2024, including a $1 billion Eurobond due in 2024.

The ratings agency added that the economic effects of the COVID-19 pandemic have slowed Ethiopia’s economic activity in the services and industry sectors, including retail trade, hospitality, transportation, and construction.

S&P described the Tigray conflict in November 2020 that followed increased tensions between the federal and local authorities as “the most significant (conflict) since Prime Minister Abby Ahmed took office in 2018.”

“Another outbreak of armed conflict could spur wider ethnic tensions, weakening Ethiopia’s political and institutional framework and threatening the government’s transformative reform agenda”, it added.

—

Ethiopia Dollar Bonds Drop After Fitch Downgrade

Reuters

Updated: February 11th, 2021

LONDON – Ethiopia’s sovereign dollar bonds dropped nearly 2 cents after Fitch downgraded the country toCCC, citing the government’s plan to make use of the new G20common framework to overhaul its debt burden.

The country’s outstanding 2024 bond dropped to as low as 92.06 cents in the dollar, according to Tradeweb data, trading close to record lows hit in late January when Ethiopia surprised markets with its announcement to seek debt relief.

“(This is) the first negative spillover from last week’s decision to go for the G20 Common Framework, a process that no euro bond issuer has been though yet, and one that could take some time, especially as private sector creditors have to be included,” said Simon Quijano-Evans, chief economist at Gemcorp Capital.

Fitch said earlier that the downgrade reflects the government’s announcement that it is looking to make use of theG20 framework, “which although still an untested mechanism,explicitly raises the risk of a default event.”

—

Related:

Update: Ethiopia Will Approach Private Creditors Only as a Last Resort

Fitch Downgrades Ethiopia Due to Debt Restructuring

The downgrade reflects the government’s announcement that it is looking to make use of the G20 “Common Framework for Debt Treatments beyond the Debt Service Suspension Initiative (DSSI)” (G20 CF), which although still an untested mechanism, explicitly raises the risk of a default event. (Fitch Ratings)

Fitch Ratings

Fitch Downgrades Ethiopia to ‘CCC’

Fitch Ratings – Hong Kong – 09 Feb 2021: Fitch Ratings has downgraded Ethiopia’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘CCC’ from ‘B’.

Fitch typically does not assign Outlooks or apply modifiers to sovereigns with a rating of ‘CCC’ or below.

KEY RATING DRIVERS

The downgrade reflects the government’s announcement that it is looking to make use of the G20 “Common Framework for Debt Treatments beyond the Debt Service Suspension Initiative (DSSI)” (G20 CF), which although still an untested mechanism, explicitly raises the risk of a default event.

The G20 CF, agreed in November 2020 by the G20 and Paris Club, goes beyond the DSSI that took effect in May 2020, in that it requires countries to seek debt treatment by private creditors and that this should be comparable with the debt treatment provided by official bilateral creditors. This could mean that Ethiopia’s one outstanding Eurobond and other commercial debt would need to be restructured, potentially representing a distressed debt exchange under Fitch’s sovereign rating criteria. There remains uncertainty over how the G20 CF will be implemented in practice, including the requirement for private sector participation and comparable treatment. Fitch’s sovereign ratings apply to borrowing from the private sector, so official bilateral debt relief does not constitute a default, although it can point to increasing credit stress.

Within the context of Paris Club agreements, comparable treatment requirements are not always enforced and the scope of debt included can vary. The Paris Club states that the requirement for comparable treatment by other creditors can be waived in some circumstances, including when the debt represents only a small proportion of the country’s debt burden.

The focus of Ethiopia’s engagement with the G20 CF will be on official bilateral debt, as reprofiling of this will have the biggest impact on overall debt sustainability. Nonetheless, the terms of the framework clearly create risk that private sector creditors will also be negatively affected. The G20 statement on the G20 CF indicates that debt treatments will not typically involve debt write-offs or cancellation unless deemed necessary. The focus will instead be on some combination of lowering coupons and lengthening grace periods and maturities. The extent of debt treatment required will be based upon the outcome of the IMF’s Debt Sustainability Analysis for Ethiopia, which is currently being updated. However, any material change of terms for private creditors, including the lowering of coupons or the extension of maturities, would be consistent with the definition of default in Fitch’s criteria.

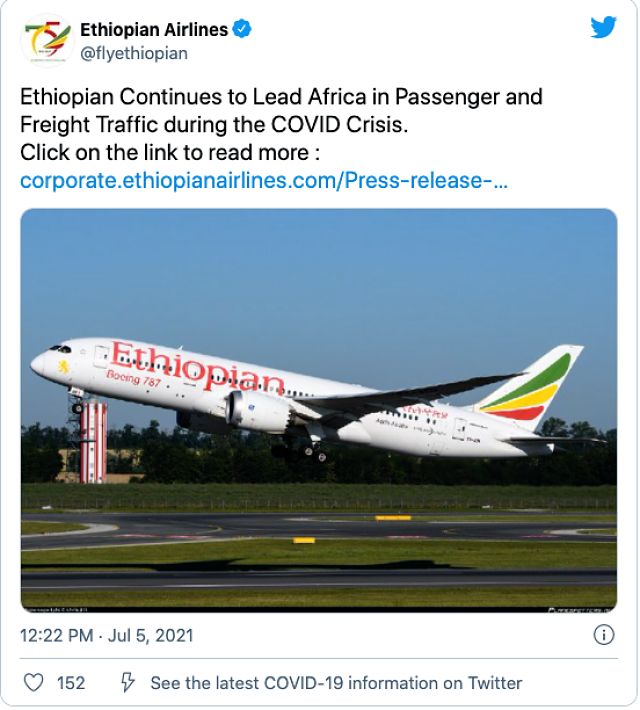

The bulk of Ethiopia’s public external debt is official multilateral and bilateral debt. Government and government-guaranteed external debt was USD25 billion in fiscal year 2020 (FY20, which ended in June 2020). Of this, USD3.3 billion was owed to private creditors. This includes Ethiopia’s outstanding USD1 billion Eurobond (1% of GDP) due in December 2024, with minimal annual debt service of USD66 million until the maturity; and USD2.3 billion government-guaranteed debt owed to foreign commercial banks and suppliers. Other SOE debt to private creditors which relates to Ethio Telecom and Ethiopian Airlines is a further USD3.3 billion. While this is not guaranteed by the government, it represents a potential contingent liability.

Ethiopia’s external finances are a rating weakness and this is the main factor behind the intention of using the G20 CF. Persistent current account deficits (CAD), low FX reserves and rising external debt repayments present risks to external debt sustainability. Ethiopia’s external financing requirements, at more than USD5 billion on average in FY21-FY22 including federal government and SOE amortisation, are high relative to FX reserves, which we forecast to remain at around USD3 billion. Reserves cover only around two months of current external payments.

The CAD narrowed to 4.1% of GDP in FY20 as imports declined, maintaining the trend since FY15 when the CAD was 12.5% of GDP. We forecast the CAD to hover around 4% of GDP, although this does not incorporate potential import costs associated with vaccines to combat the coronavirus pandemic. Smaller CADs have not eased pressure on FX reserves because net FDI has been lacklustre (averaging 2.7% of GDP in FY19-FY20) and net external borrowing has moderated with negative net borrowing by SOEs. The central bank has allowed sharper exchange rate depreciation, but the currency nonetheless remains overvalued, with a weaker rate in the parallel market. Proposed sales of mobile licenses and a stake in Ethio Telecom, the state-owned telecoms company, are an upside risk to FDI inflows and reserves in FY21-FY22.

The IMF assessed Ethiopia at high risk of external debt distress in its latest assessment in 2020, with Ethiopia breaching thresholds on external debt service/exports and the present value of external debt/exports. An improvement from high to moderate risk is a central aim of the three-year arrangement with the IMF agreed in late 2019 under the Extended Credit Facility and the Extended Fund Facility. Given the difficulty of substantially boosting exports in the near term, the main route to achieve this is via reducing debt service costs. Within the IMF programme, the authorities planned by the first review to undertake additional reprofiling of bilateral loans but this has not yet happened. The pandemic has placed further emphasis on debt reprofiling.

Ethiopia and the IMF reached staff-level agreement on the first review of the programme in August 2020, but this awaits board approval. The Fund’s press release recognised that performance had mostly been good, but also emphasised the need for financial support from Ethiopia’s international partners including through debt reprofiling.

Ethiopia’s ‘CCC’ IDRs also reflect the following key rating drivers:

Strong economic growth potential and an improving policy framework support the rating, while double-digit inflation, low development and governance indicators and elevated political risks weigh on the rating.

The coronavirus pandemic continues to present significant risks to Ethiopia, but the negative economic impacts since the onset have been somewhat contained so far. Given that the fiscal year ends in June, we do expect more of a hit to growth in FY21 than FY20, but forecast a return to growth rates in the 6%-7% range over the medium term. The government has maintained considerable budgetary discipline, with moderate increases in the general government budget deficit, to 2.8% of GDP, and government debt/GDP (31.5%), while total SOE debt/GDP (25.6%) has fallen. However, the pandemic presents risks of upward pressure on spending. Government financing has continued its transition towards market-based T-bill auctions and away from the long-standing system of direct advances from the National Bank of Ethiopia (NBE, the central bank). This is a core part of the IMF programme, which seeks to promote monetary policy reforms to help gradually tackle inflation that has remained extremely high at close to 20%.

The military conflict in the Tigray region from November 2020 has underlined ongoing political risks in Ethiopia as well as for Ethiopia’s international relations. Considerable domestic political uncertainty, related to the delayed 2020 parliamentary election (now planned for June) and ongoing ethnic and regional tensions within the country, remains a risk to Ethiopia’s credit metrics, in Fitch’s view. Greater political unrest could, for example, act as a drag on FDI and tax collection and exert further upward pressure on inflation. It could also lead to worsening relations with some bilateral partners and hold up donor flows, as illustrated by the suspension of some flows from the EU in December.

ESG – Governance: Ethiopia has an ESG Relevance Score (RS) of 5 for both Political Stability and Rights and for the Rule of Law, Institutional and Regulatory Quality and Control of Corruption, as is the case for all sovereigns. Theses scores reflect the high weight that the World Bank Governance Indicators (WBGI) have in our proprietary Sovereign Rating Model. Ethiopia has a low WBGI ranking in the 25th percentile, reflecting in particular political instability, as well as low scores for voice and accountability and regulatory quality.

RATING SENSITIVITIES

The main factors that could, individually or collectively, lead to negative rating action/downgrade:

- Structural Features: Stronger evidence that Ethiopia’s engagement in the G20 CF will lead to comparable treatment for private sector creditors consistent with a default event under Fitch’s criteria.

- External Finances: Increased external vulnerability that heightens the risk of default irrespective of the G20 CF, such as the emergence of external financing gaps and downward pressure on already low foreign-exchange reserves.

The main factors that could, individually or collectively, lead to positive rating action/upgrade are:

- Structural Features: Clarity that the G20 CF will not lead to a default event.

- External Finances: Stronger external finances with acceleration in exports, for example, leading to smaller CADs and higher foreign-currency reserves.

SOVEREIGN RATING MODEL (SRM) AND QUALITATIVE OVERLAY (QO)

In accordance with the rating criteria for ratings in the ‘CCC’ range and below, Fitch’s sovereign rating committee has not used the SRM and QO to explain the ratings, which are instead guided by the rating definitions.

Fitch’s SRM is the agency’s proprietary multiple regression rating model that employs 18 variables based on three-year centred averages, including one year of forecasts, to produce a score equivalent to a LT FC IDR. Fitch’s QO is a forward-looking qualitative framework designed to allow for adjustment to the SRM output to assign the final rating, reflecting factors within our criteria that are not fully quantifiable and/or not fully reflected in the SRM.

BEST/WORST CASE RATING SCENARIO

International scale credit ratings of Sovereigns, Public Finance and Infrastructure issuers have a best-case rating upgrade scenario (defined as the 99th percentile of rating transitions, measured in a positive direction) of three notches over a three-year rating horizon; and a worst-case rating downgrade scenario (defined as the 99th percentile of rating transitions, measured in a negative direction) of three notches over three years. The complete span of best- and worst-case scenario credit ratings for all rating categories ranges from ‘AAA’ to ‘D’. Best- and worst-case scenario credit ratings are based on historical performance. For more information about the methodology used to determine sector-specific best- and worst-case scenario credit ratings, visit [https://www.fitchratings.com/site/re/10111579].

KEY ASSUMPTIONS

We assume that Ethiopia pursues involvement in the G20 CF.

We expect global economic trends and commodity prices to develop as outlined in Fitch’s Global Economic Outlook.

REFERENCES FOR SUBSTANTIALLY MATERIAL SOURCE CITED AS KEY DRIVER OF RATING

The principal sources of information used in the analysis are described in the Applicable Criteria.

ESG CONSIDERATIONS

Ethiopia has an ESG Relevance Score of 5 for Political Stability and Rights as World Bank Governance Indicators have the highest weight in Fitch’s SRM and are therefore highly relevant to the rating and a key rating driver with a high weight.

Ethiopia has an ESG Relevance Score of 5 for Rule of Law, Institutional & Regulatory Quality and Control of Corruption as World Bank Governance Indicators have the highest weight in Fitch’s SRM and are therefore highly relevant to the rating and are a key rating driver with a high weight.

Ethiopia has an ESG Relevance Score of 4 for Human Rights and Political Freedoms as the Voice and Accountability pillar of the World Bank Governance Indicators is relevant to the rating and a rating driver.

Ethiopia has an ESG Relevance Score of 4 for Creditor Rights as willingness to service and repay debt is relevant to the rating and is a rating driver, as for all sovereigns.

Except for the matters discussed above, the highest level of ESG credit relevance, if present, is a score of 3. This means ESG issues are credit-neutral or have only a minimal credit impact on the entity(ies), either due to their nature or to the way in which they are being managed by the entity(ies). For more information on Fitch’s ESG Relevance Scores, visit www.fitchratings.com/esg.

—

Africa Report: Ethiopia Debt Restructuring Plan Faces Hurdles of Transparency

(Reuters photo)

The Africa Report

Ethiopia’s plan to seek debt restructuring under a G20 common framework agreed in November triggered a sell-off in African debt at the end of January on fears of a contagion effect.

The framework enables debtor countries to seek an IMF programme to strengthen their economies and renegotiate their debts with public and private creditors. But such a debt restructuring for Ethiopia would face barriers due a lack of transparency, analysts say.

Any attempt to reconcile balance of payments and published public external debt figures with underlying debt-creating flows shows information gaps and supports “a narrative of opaque lending”, argues Irmgard Erasmus, senior financial economist at NKC African Economics in Cape Town.

Along with Djibouti and Zambia, Ethiopia’s dealings with China “raise the probability of higher-than-estimated debt contracted by extra-budgetary units (EBUs) as well as potentially large contingent liabilities,” she writes in a research note.

China does not publish official or non-official bilateral debt agreements with central governments or state-owned enterprises, she notes.

The channel through which private-sector participation in the framework can be forced is not clear, Erasmus says.

“The agreement of the principles of the G20 Common Framework is positive but negotiations in actual restructurings are likely to be challenging,” says Mark Bohlund, senior credit research analyst at REDD Intelligence in London. Lack of clarity on what is owed to China is one obstacle. While he hasn’t seen any firm evidence of Chinese loans to Ethiopia being understated, there is “less transparency” on Chinese lending, he says.

The fact that India and Turkey, which are non-Paris club G20 lenders, are the largest bilateral creditors after China, may complicate an Ethiopian restructuring, Bohlund says.

A further stumbling block is reluctance from debtor nations to participate in fear of adverse credit rating actions. African countries intending to tap international debt markets this year, such as Tunisia, Ghana and Kenya, may be reluctant to join the initiative, Erasmus says.

Unrealistic growth outlook

For Africa, recent sharp declines in external borrowing costs for many countries amid global optimism on emerging markets provides a “silver lining” to the cloud of debt woes, according to Jacques Nel, head of Africa macro at NKC. “Markets are now open to lending to many sub-Saharan African sovereigns, which could provide the necessary fiscal breathing room in 2021.”

But official Ethiopian projections for annual economic growth of 8.4% are dismissed by Erasmus. NKC predicts growth of 2.2% given the “dire fiscal position and balance of payments risks.”

“The near-term outlook is clouded by political tensions ahead of the June election, reputational risks related to armed conflict in Tigray, an upsurge in desert locust infestation and forex shortages,” Erasmus writes.

That means the long-awaited liberalisation of Ethiopia’s high-potential sectors such as telecommunications and banking is now urgent. This would be the “crucial first step in addressing structural vulnerability and lowering government debt dependence,” Erasmus argues.

Read more »

—

UPDATE: Ethiopia May Engage Private Creditors After Debt Review

Ethiopia is looking to offset the impact of the pandemic on its economy. (Getty Images)

Bloomberg

Updated: February 2nd, 2021

Ethiopia may approach private creditors for debt talks after it reviews liabilities with official lenders amid security risks that are adding to investors’ worries.

The nation’s Eurobonds plunged the most on record last week after State Minister of Finance Eyob Tekalign said the government will seek to restructure its external debt under a Group of 20 debt-suspension program. With no details on how the decision would affect holders of Ethiopia’s $1 billion of 2024 Eurobonds, many investors responded by selling the securities.

Only after talks involving official creditors, which the International Monetary Fund is assisting with, will the government be able to inform other creditors on the “need for broader debt treatment discussions,” the finance ministry said in a press statement on Monday.

Yields on Ethiopia’s $1 billion of 2024 Eurobonds climbed 26 basis points to 8.85% by 1:50 p.m. in London after jumping 207 points on Friday to the highest since May. The premium investors demand to hold the nation’s dollar bonds rather than U.S. Treasuries widened 31 basis points to 807, compared with the 538 average for African sovereign issuers, according to JPMorgan Chase & Co. indexes.

“In theory, a common framework should speed up the debt restructuring process, but it remains to be tested,” Morgan Stanley & Co. analysts Jaiparan Khurana and Simon Waever said in a note. “Questions around enforceability of the MoU terms to the private sector still persist, especially considering that the private sector is not a signatory.”

Ethiopia is the second African country after Chad to announce plans to review debt under the G-20 common framework, which aims to include China and private lenders into a global debt-relief push.

Ethiopia, like other African nations, is looking to offset the impact of the coronavirus pandemic on its economy. Ethiopia’s position is, however, exacerbated by fighting in the northern Tigray region and a border dispute with Sudan that’s threating to further destabilize the region.

“Possible implementation of the debt treatment under the Common Framework will address the debt vulnerabilities of the country, while preserving long-term access to international financial markets,” the finance ministry said in the statement. That will help in “unlocking more growth potential,” it said.

As with earlier bilateral debt relief, including via the Paris Club, Eurobond holders can choose not to participate in the program, according to the Morgan Stanley analysts. “The key issue would be how insistent bilateral creditors would be on the private sector participating,” they said.

—

Related:

Ethiopia to Seek Debt Relief Under G20 Debt Framework – Ministry

Under the new G20 framework, debtor countries are expected to seek an IMF programme to steer their economies back to a firmer ground and negotiate a debt reduction from both public and private creditors.(Getty Images)

Reuters

Updated: January 30th, 2021

Exclusive: Ethiopia to seek debt relief under G20 debt framework – ministry

Ethiopia plans to seek a restructuring of its sovereign debt under a new G20 common framework and is looking at all the available options, the country’s finance ministry told Reuters on Friday.

G20 countries agreed in November for the first time to a common approach for restructuring government debt to help ease the financial strain of some developing countries pushed towards the risk of default by costs of the coronavirus crisis.

Chad became on Wednesday the first country to officially request a debt restructuring under the new framework and a French finance ministry told Reuters on Thursday that Zambia and Ethiopia were most likely to follow suit.

Asked if Ethiopia was looking to seek a debt restructuring under the G20 framework, Finance Ministry spokesman Semereta Sewasew said: “Yes, Ethiopia will look at all available debt treatment options under the G20 communique issued in November.”

Ethiopia’s government bond due for repayment in 2024 which it issued back in late 2014 saw its biggest ever daily fall. It plunged 8.4 cents on the dollar from roughly par to just under 92 cents.

Ethiopia is already benefiting from a suspension of interest payments to its official sector creditors through the end of June under an initiative between the G20 and the Paris Club of creditor nations.

Under the new G20 framework, debtor countries are expected to seek an IMF programme to steer their economies back to a firmer ground and negotiate a debt reduction from both public and private creditors.

—

Join the conversation on Twitter and Facebook.

In the following article, Dr. Nemo Semret, co-founder of QRB Labs, the pioneering company that introduced Bitcoin mining to Ethiopia, shares insights on the benefits and drawbacks of the Bitcoin potential in the country, alongside the recent global media attention on this subject. (Photo: The Grand Ethiopian Renaissance Dam serves as an abundant power source for Bitcoin miners/Getty Images)

In the following article, Dr. Nemo Semret, co-founder of QRB Labs, the pioneering company that introduced Bitcoin mining to Ethiopia, shares insights on the benefits and drawbacks of the Bitcoin potential in the country, alongside the recent global media attention on this subject. (Photo: The Grand Ethiopian Renaissance Dam serves as an abundant power source for Bitcoin miners/Getty Images)